PersonalFN's

Presents

How To Become

Your Own Financial Planner?

An exclusive Program To Develop The Skills To Manage Your Personal Finance

We believe by signing up for the initiative, you too endeavour to develop the skills needed to understand the nuances of personal finance and be money-wise.

Module II: How To Plan Your Key Life Goals

Session 5: 6 Factors To Determine The Corpus You Need For Your Financial Goals

Financial Planning is a process that draws a roadmap to accomplishing your financial goals. It even helps managing personal finances prudently, and puts budgets in place for a variety of expenses: household, lifestyle, children's education, EMI on loans, and so on; including contingencies that are always looming.

However, financial planning is exhaustive! When you say I want an 'x' amount after 'x' number of years, you need to take into account a host of factors and analyse these thoroughly.

So, in today's session we'll talk about...

6 Factors to Determine the Corpus You Need For Your Financial Goals

Where do you stand today?

The first step in doing anything of importance is to assess where you stand today and where want to reach after a specific time period. A vital self-analysis of where you stand today is must!

-If you've borrowed, ensure that your debts are in check. Too much debt can be hazardous to your long-term financial wellbeing. Here's a ratio that can help you assess...

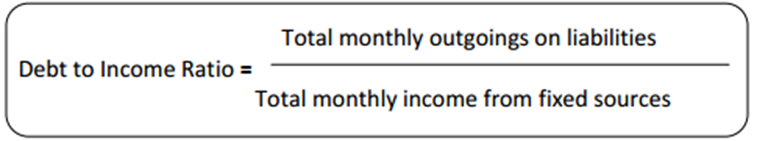

Debt to Income Ratio:

This ratio will help you gauge how much to borrow vis-a-vis your income. Higher the D/I ratio, higher chances more the trouble to repay.

Ideally, this ratio should not exceed 40% of your income gross income. Likewise, you should aim to save more.

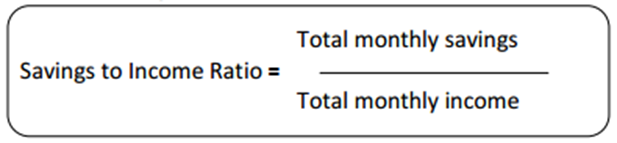

Savings to Income Ratio:

Remember, the more you save and invest during the earnings phase of life, the less you will have to worry later. So, engage in a budgeting exercise with diligence, and aim to save at least 1/3rd of your net monthly earnings.

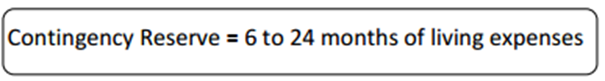

Hope for the best, but plan for the worst as well. Pay heed to how much you're holding as contingency reserve.

Contingency Reserve:

Ideally, set aside 6 to 24 months of regular monthly expenses (including EMIs) as a contingency reserve which will help you manage during a rainy day, or in case of exigencies.

Once you implement these simple financial fundamentals, you'll be in better control of your finances.

- Where do you want to reach?

You may have various aspirations, but be realistic and prioritise your financial goals.

Classify financial goals based on their priority and proximity:

Short term (less than 3 years)

Medium term (3 to 5 years)

Long term (more than 5 years)

This will help you to know which goals to prioritise and therefore channelize your investments accordingly, based on the time to the goal and your risk profile.

For example...

| GOAL |

PRIORITY (LOW/MEDIUM/HIGH) |

TIME FOR GOAL FULFILMENT |

| Child’s college education |

High |

9 years |

| Child’s marriage |

Medium |

12 years |

| Retirement |

High |

15 years |

| Foreign Vacation |

Low |

16 years |

(Source: PersonalFN Research)

Making such a table will lead to better clarity of your financial goals, the time you have, and therefore how to prioritise. A child's college education and retirement are top priority vis-a-vis foreign vacation. Ensure that your financial goals are S.M.A.R.T.

Know the investment horizon:

This is the time you have to achieve your financial goals. The time for goal fulfilment helps to structure the investment strategy. So, when contemplating an investment, clearly know the time you have before the goal needs to be accomplished. This can then help you decide what type of investment avenues within respective asset classes you should consider, and the one's you should totally give a miss.

Know your 'risk profile':

Without recognising this you may be opting for a rollercoaster or bullock cart ride. Meaning, you could either land up with investments that are highly volatile, or those which are absolutely dull, not meant to achieve the financial goals you've envisioned.

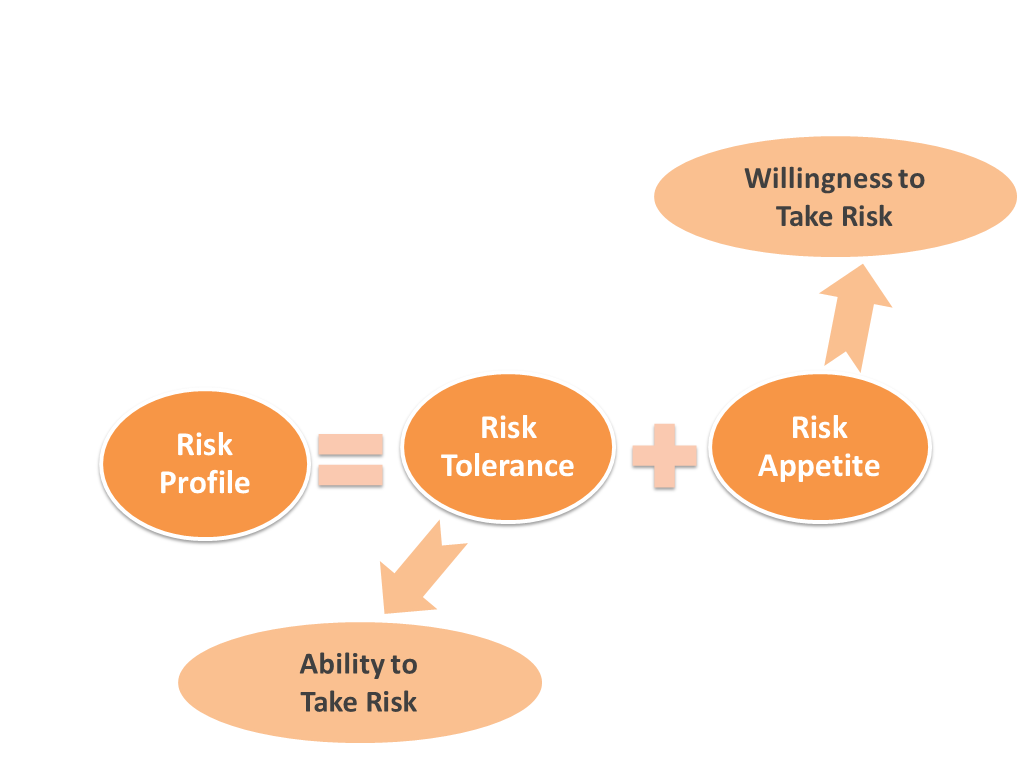

'Risk profile' is made up of two components: Your 'risk tolerance' and your 'risk appetite'.

Risk profile = Risk Tolerance + Risk Appetite

'Risk appetite' simply refers to how much risk you're willing to take.

While 'Risk tolerance' refers to your ability to take a specific degree of risk - how you can really handle it.

For example:

Mr Patel is a 32 year old young man, and an expectant father.

-He earns a handsome monthly salary;

-Manages his expenses well;

-Doesn't have too many responsibilities to shoulder;

His financial goals are 10 years from now; and

-Is suitably covered with life and health insurance policy

Given all these conditions, his risk appetite may be high.

But his 'risk tolerance' may not, led by fact such as:

-He's lost money in stock markets in the past; and

-Does not have the knowledge or sound perspective on investing;

So, you ought to finely assess your own 'risk profile' to make prudent investment decisions.

- Look where inflation is headed:

Inflation erodes the purchasing power of money. Something that costs you Rs 100 today may cost you Rs 110 tomorrow. Imagine what it would cost you when you retire after long years of work life.

Let us understand how inflation plays a spoiler with the help of an example...

Mr Gupta has a 6 year old daughter. He plans to send his daughter to college for post-graduation at age 21, for which he will spend Rs 15 lakh and plans for her marriage at age 26. He plans to accumulate an amount to the Rs 25 lakh in present value terms.

Assuming inflation in college education and marriage expenses @ 8% p.a. on a conservative side, Mr Gupta would need a corpus of Rs 47.58 lakh to fund higher education, which today, in present times costs Rs 15 lakh today

For her wedding expenses, assuming inflation @8%, again on a conservative side, he would require a sum of Rs 1.16 crore.

Investment avenues:

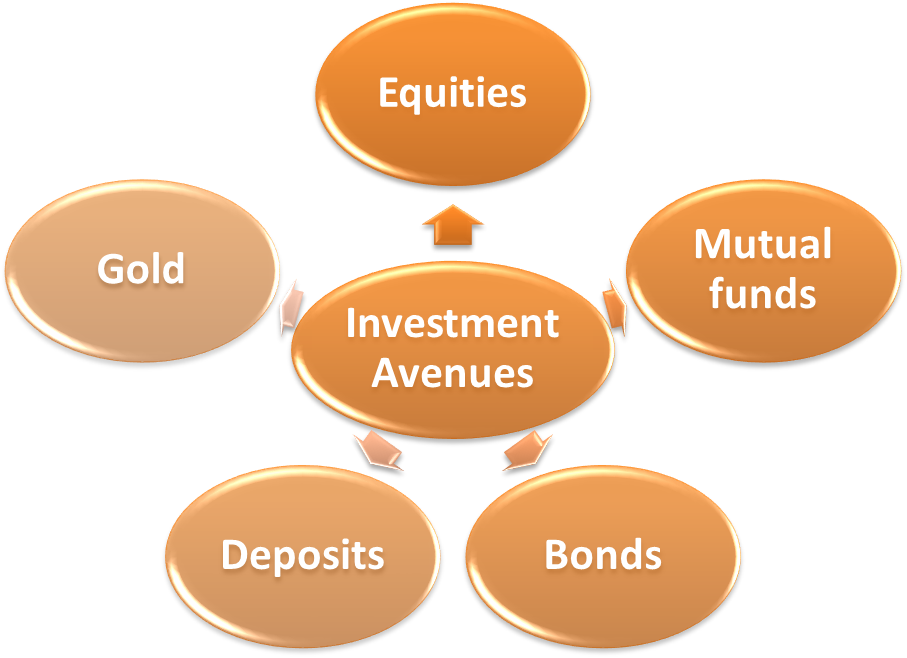

Once you've ascertained these factors prudently, to achieve your financial goals, invest in a variety of investment avenues...

Equities - Equity is a type of security that represents the ownership in a company. Investing in equities is a good long-term investment option, as the returns on equities over a long time horizon are generally higher than most other investment avenues. However, along with the possibility of greater returns comes greater risk.

Mutual funds - A mutual fund allows a group of people to pool their money together and have it professionally managed, in keeping with a predetermined investment objective. This investment avenue is popular because of its cost-efficiency, risk-diversification, professional management, and sound compliance to regulation. You can invest as little as Rs 1,000 per month in a mutual fund. There are various general and thematic mutual funds to choose from and the risk and return possibilities vary accordingly.

Bonds - Both private entities, such as companies, financial institutions, and the Central or State government and other government institutions use this instrument as a means of garnering funds. Bonds issued by the Government carry the lowest level of risk, however could deliver fair returns.

Deposits - Investing in bank or post-office deposits is a very common way of securing surplus funds. These instruments are at the low end of the risk-return spectrum.

Gold - The precious yellow metal can act as a hedge or a store of value, particularly when markets are volatile. It doubles up as an effective portfolio diversifier. But ensure that you invest in gold the smart way, preferably through gold ETF as against physical gold.

Here's a table of investment avenues vis-a-vis the risk they carry and the investment horizon. The table will help you make better investment decisions...

Investment Avenues |

Risk Traits |

Investment Horizon |

Equity: |

|

|

|

Very high |

> 3 years |

|

High to very high |

> 3 years |

Debt: |

|

|

|

Low |

As per time horizon |

- Public Provident Fund (PPF) etc.

|

Low |

Long term |

Debt Mutual Fund: |

|

|

- Long Term Debt Mutual Fund

|

Moderate to High |

At least 3 years |

- Short Term Debt Mutual Fund

|

Moderate |

< 3 years |

- Ultra-Short Term Debt Mutual Fund

|

Low to Moderate |

3 to 6 months |

|

Low |

< 3 months |

Gold (ETF) |

Moderate to high |

> 10 years |

(Source: PersonalFN Research)

Besides when you invest, make sure you follow a customized asset allocation model. Here is a bird's eye view on the ideal asset allocation based on time horizon...

ASSET ALLOCATION |

Years to goals |

Equity |

Debt |

Gold |

<=3years |

< 10% |

> 85% |

< 5% |

4 years |

40% |

55% |

5% |

5 years |

45% |

45% |

10% |

6-7 years |

55% |

35% |

10% |

8-10 years |

70% |

20% |

10% |

> 10 years |

80% |

10% |

10% |

(Source: PersonalFN Research)

Right now, we won't discuss on the importance of asset allocation. We have covered the importance of striking the right asset allocation in lecture no. 11 and we will discuss it in detail then.

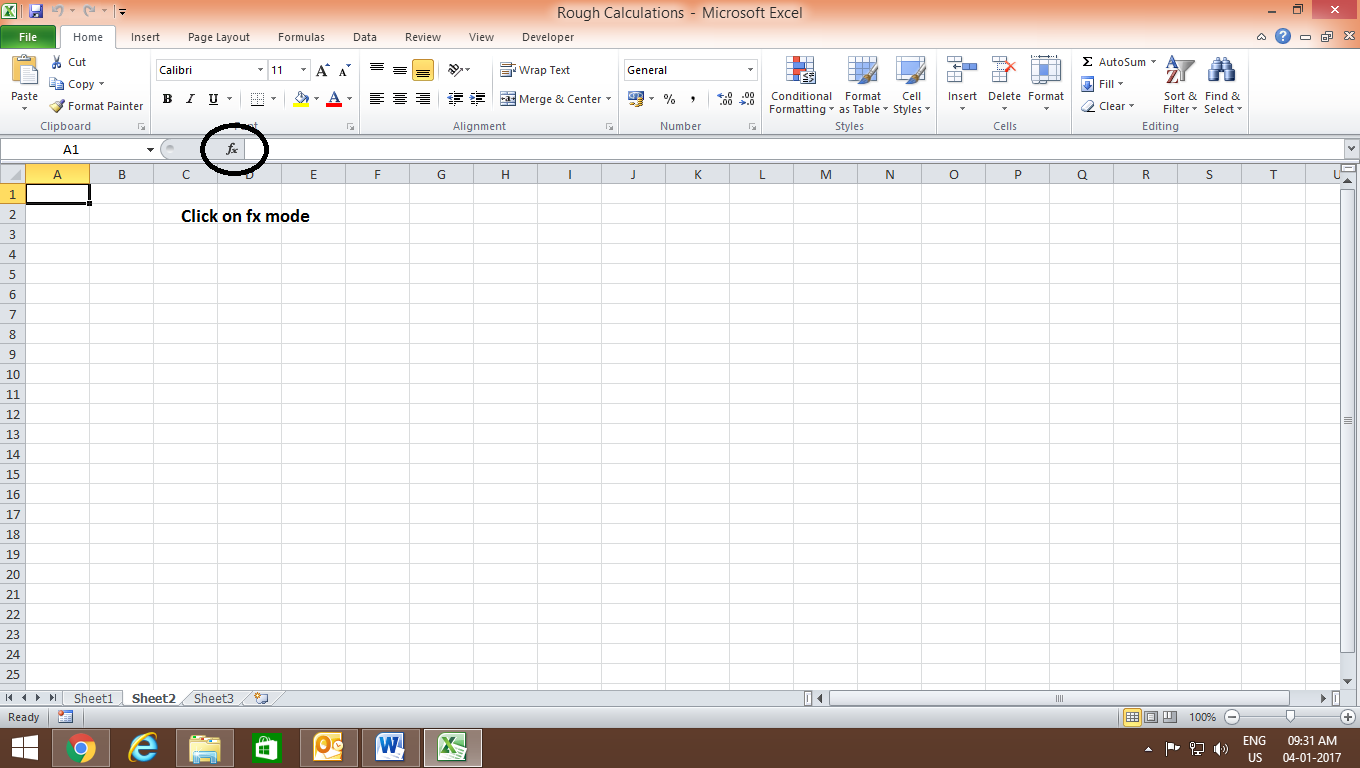

Remember to use the formula FV = PV (1+r)n to calculate the future value of your financial goals.

In this formula:

FV = Future Value

PV = Present Value

r = Rate of return

n = Number of years

Let us understand how to calculate the Future Value (FV) of a goal with the help of an example...

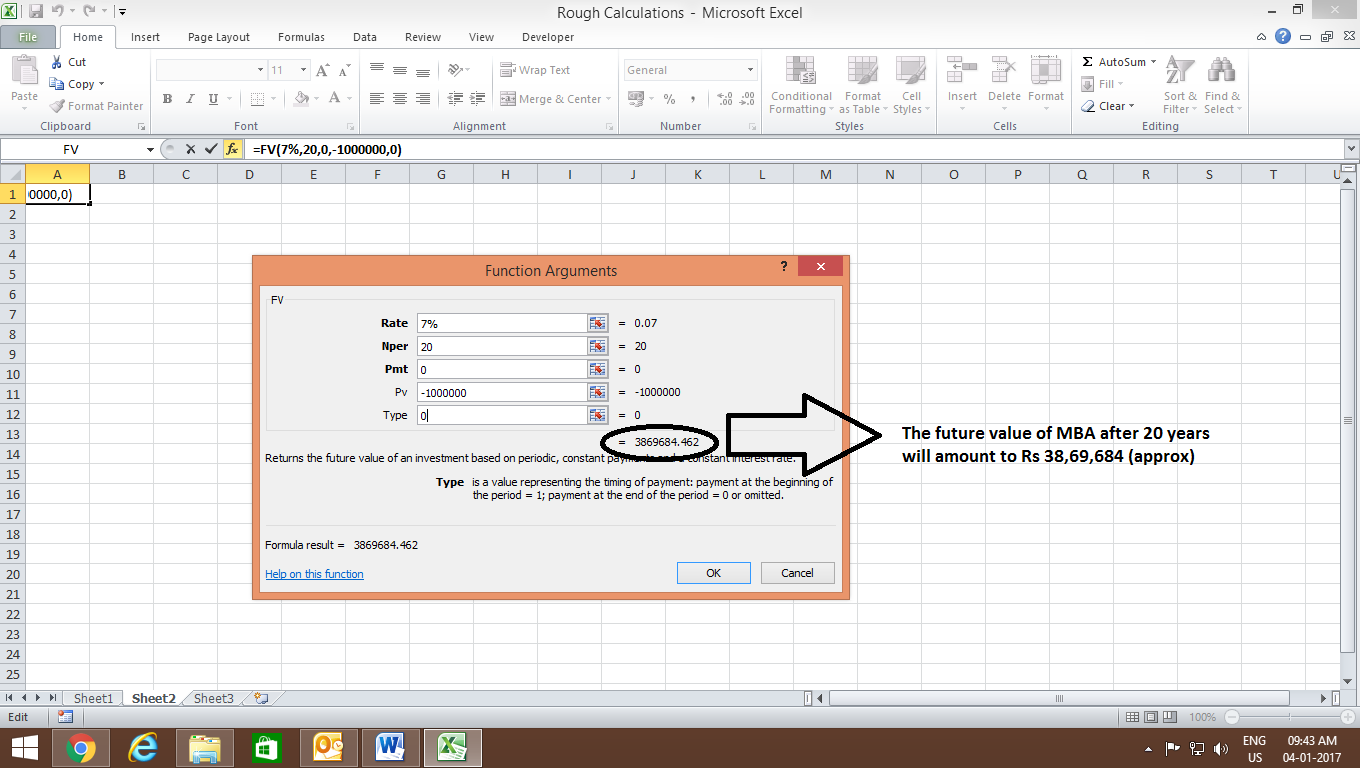

The cost of pursuing your MBA today is Rs 10 lakhs. After 20 years at an inflation rate of 7% p.a. the cost would be?

Step 1: Open an excel sheet and click on fx function:

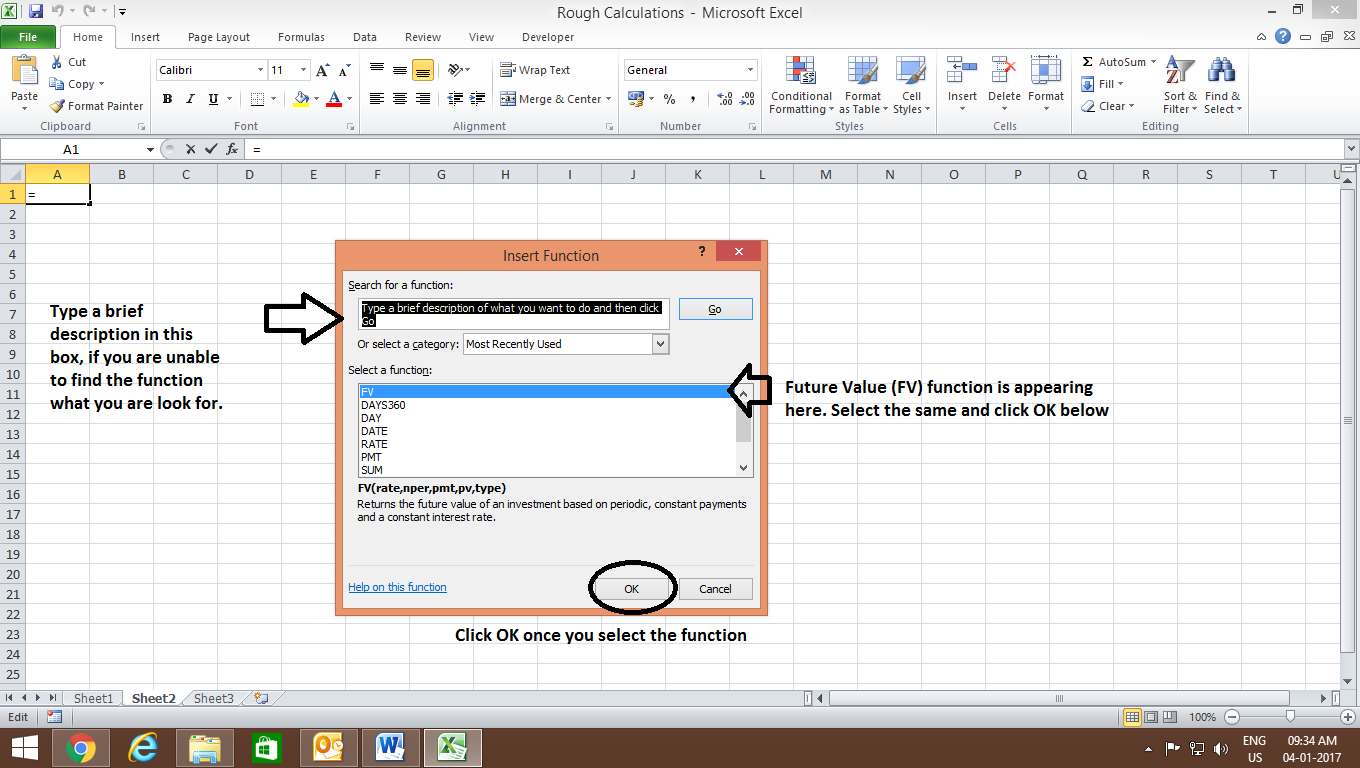

Step 2: Once you click on the fx function the following screen appears

Step 3: Once you click on OK, this screen will appear wherein you need to fill the details, as shown here:

Finally, here are a few...

Points to Remember

The first step in doing anything of importance is to assess where you stand today and where you want to reach after a specific time period.

The second step is to know the time horizon you have before the financial goals befall.

Quantify your financial goals, prioritise them, and classify into short-term, medium-term, and long-term.

- Time is money. The earlier you start investing for the long term the higher the chances of earning sizeable returns.

The higher rate of return, ('r') you can earn and the longer 'n' (time period) you can invest for; the larger your Future Value of money will be.

Inflation erodes the purchasing power of your money; so account for it wisely.

Know your risk profile.

Invest regularly in a disciplined manner.

Select investment avenues wisely, don't ignore asset allocation while you invest to meet your financial goals.

Don't forget that financial planning is an exhaustive process that can provide a roadmap to achieve financial goals.

Thank You For Participating!

Disclaimer: This is for Private Circulation only and is not for sale. The content is only for information purposes and Quantum Information Services Private Limited ( PersonalFN) is not providing any professional/investment advice through it. It does not constitute or is not intended to constitute an offer to buy or sell, or a solicitation to an offer to buy or sell financial products, units or securities. PersonalFN disclaims warranty of any kind, whether express or implied, as to any matter/content contained herein, including without limitation the implied warranties of merchantability and fitness for a particular purpose. PersonalFN and its subsidiaries / affiliates / sponsors / trustee or their officers, employees, personnel, directors will not be responsible for any direct/indirect loss or liability incurred by the user as a consequence of his or any other person on his behalf taking any investment decisions based on the content herein. It should be used at the user's own risk. The user must make his own investment decisions based on his specific investment objective and financial position and using such independent advisors as he believes necessary. PersonalFN does not warrant completeness or accuracy of any information published herein. All intellectual property rights emerging from this transcript content are and shall remain with PersonalFN. This is for your personal use and you shall not resell, copy, or redistribute this transcript, or use it for any commercial purpose. All names and situations depicted in the transcript content are purely fictional and serve the purpose of illustration only. Any resemblance between the illustrations and any persons living or dead is purely coincidental.