We believe by signing up for the initiative, you too endeavour to develop the skills needed to understand the nuances of personal finance and be money-wise.

Having a history of educating and guiding investors since 1999, PersonalFN has often emphasized on maintaining proper asset allocation in one's investment portfolio.

At PersonalFN we consider asset allocation as an important element in the process of achieving ones financial goals. You see, building an investment portfolio through optimal asset allocation is imperative while you endeavour to achieve your financial goals.

So in this session, we'll explain...

You may ask, "Why asset allocation? Can't I straight away get to those great investment ideas that can earn big returns for me?"

Yes you can, but only when you're confident about that great investment idea. Most importantly, it should be suitable for you. Or else you may be out of the frying pan, into the fire. You cannot rule out the risks that come with those rewarding ideas, which ultimately have to match your risk profile as well.

So you need to...

And you can do it by... following the right investment strategy.

By allocating your investments across various asset classes, you can minimize risk, and potentially maximise gains in the long run.

Asset allocation may sound like a complicated concept, but it isn't! Through appropriate asset allocation, you can distribute your investible surplus across asset classes such as equity, debt, gold, or even holding cash for that matter.

When you ask yourself - "Which asset must form part of my investment plan?" Most investors would qualify to own all viz. equity, debt, real estate, gold, and cash.

However, when it boils down to "How much of each asset should one own", it gets a little tricky, because it varies from investor to investor.

Different assets hold respective traits; they have different moods based on the market scenario. Hence, if your asset allocation is done prudently, it may reduce the shocks of a single asset class in your portfolio.

Let us now take a look at what kind of asset allocation would be suitable for you...

For Individuals between 25 to 35 years having the time horizon of 35 to 45 Years:

We would first like to congratulate you, if you fall in this former age bracket of 25 to 35 years. You have made an early decision about your retirement. You have just begun the Asset Accumulation phase of your life.

This is the time when you plan for various life goals, Retirement being one of them.

In the long run, your goal is wealth creation. Soon you would plan to buy a house, your dream car, get married, and later perhaps even save for your child's future.

This is the time when you have enough flexibility to plan your income and streamline it towards meeting your goals, and even set your lifestyle.

So, given your other goals, you need to prioritise. Once you have planned well for your other life goals, you can simultaneously look towards building your retirement portfolio based on the retirement corpus you would require.

Though your preferences might change over time, it'll draw a fair idea about what you want to achieve, and assist you to invest accordingly. The wise habit of budgeting can help you control how to utilise finances and achieve financial goals. Also, being in the early stage of life and having many years before retirement, you might have the flexibility to reconsider your retirement age, if required.

Usually in this age bracket, the time horizon you have is around 35 to 45 years. This facilitates taking very high risks to enhance growth potential of your portfolio in the long run. You can be very aggressive while building your retirement portfolio, given the longer time horizon.

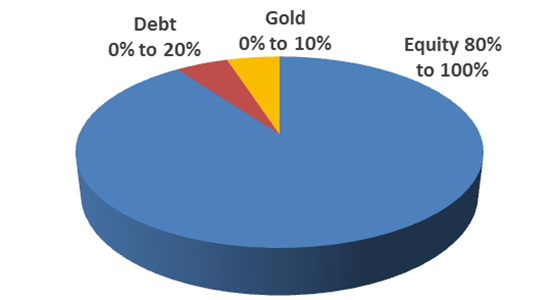

Portfolio Type-Very Aggressive

The chart above is indicative

The chart above is indicative

(Source: PersonalFN Research)

For long term growth, you can take higher equity exposure at this stage. Based on your age and risk appetite, you can position around 80% to 100% of your portfolio towards equities. This would help grow your wealth in the long run. You can consider investing in a mix of mid- and large-cap funds to diversify your portfolio across market caps. Being in the initial stage, you can start with SIPs in mutual funds since you may not have the expertise to invest directly in equities. Do not fall for trading in equity markets - it can be hazardous for wealth and health. Also don't borrow funds to invest in equities.

For Individuals between 35 to 45 years having a time horizon of 25 to 35 Years:

In this age bracket, you are in the Mid-Asset Accumulation phase of your life.

This is when you plan to achieve some of your goals viz. buy a house, your dream car. Also you begin to save your child's education.

But in the bargain, ensure you don't derail your retirement, which is a vital financial goal of life. Determine the retirement corpus you need, and plan your investments accordingly.

Also, plan for ways to grow your income and cut down on unnecessary expenses. Being in the early mid-accumulation phase of life, you even have some flexibility to reconsider your retirement age, if required.

Usually you have a time horizon of around 25 to 35 years before you hang up your boots. Therefore you can take higher risk to increase returns on your retirement portfolio. You can be aggressive while building your retirement portfolio given the longer time horizon.

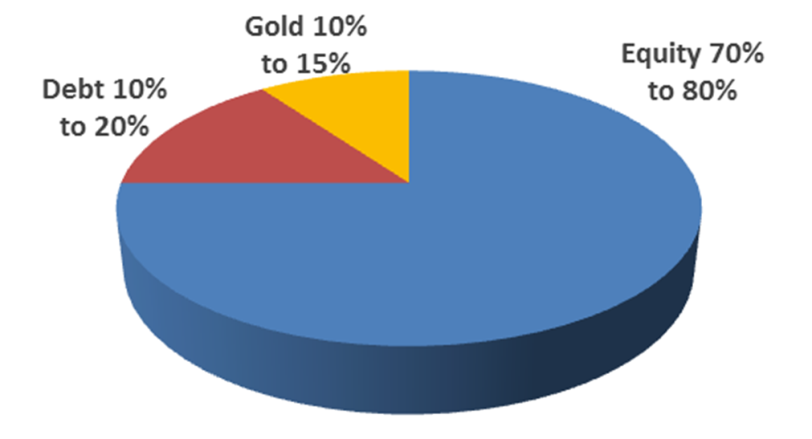

Portfolio Type - Aggressive

The chart above is indicative

The chart above is indicative

(Source: PersonalFN Research)

Based on your age and risk appetite, around 70% to 80% of your portfolio could be inclined towards equities. This would give a boost to the overall potential returns of your portfolio in the long run. Consider investing in a mix of large- and mid-cap funds to diversify your portfolio across market caps. A staggered approach of investing vide SIPs can help you sail through volatility. If you've developed your own conviction and acumen towards investing directly in equity markets, you may hold 5 to 6 good dividend yielding large-cap and growth oriented mid-cap stocks in your portfolio with a long term view.

For Individuals between 45 to 55 Years having a time horizon of 15 to 25 Years:

In this age bracket, you are in the Conservation and Protection phase of your life.

You might have bought your dream home, a car; but now addressing to your child's higher education and marriage needs, or even shifting to the larger, more comfortable home.

But let prudence prevail over your retirement. Make sure you're on the path leading a financially secure retired life. Chances are high that you may be fall short of the retirement corpus you need. This is the right time to plan for ways to cover-up the shortfall, if any. Reconsider your income and expenses and/or enhance your income through secondary source, if possible. Besides, you can even reconsider your retirement age if required.

Usually, you'll have a time horizon of 15 to 25 years before you retire. So, given the conditions, you can assume some risk to enhance the growth potential of your retirement portfolio. It's best not to be too conservative at this stage. Moderately allocate your assets.

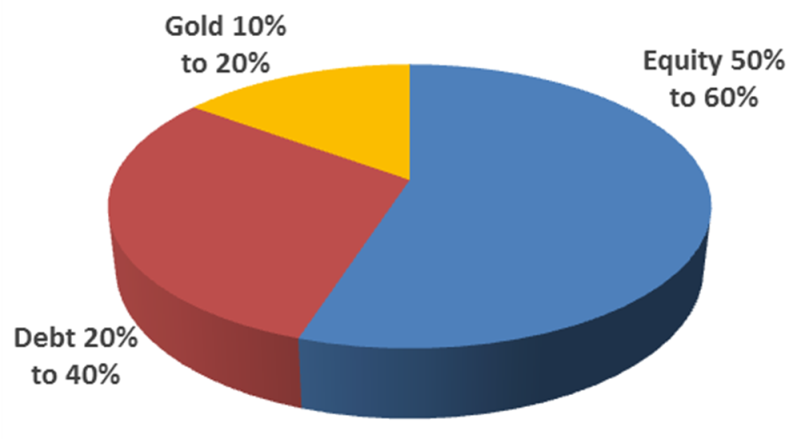

Portfolio Type - Moderate

The chart above is indicative

The chart above is indicative

(Source: PersonalFN Research)

Based on your age and risk appetite, around 50% to 60% of your portfolio can be inclined towards equities. This will give a boost to your overall portfolio returns in the long run. Consider investing in a mix of large, mid, and multi cap funds respectively and preferably opt for the SIP mode of investing. If you've developed the acumen to directly invest in equities, you may hold 5 to 6 good dividend yielding large cap and mid cap stocks in your portfolio with a long term view.

For Individuals between 55 to 60 Years having a time horizon of 10 to 15 Years:

In this age bracket, you are in the final stage of Conservation and Protection. You're aware of the financial risk of soon waving a goodbye to your current regular source of income. These are your final years to build a corpus for your retirement.

At this stage, the appetite to take high risk reduces. You would prefer to protect what you've earned and fulfil your other commitments that are approaching.

So, depending on your age and investment horizon, a cautious, conservative approach would benefit your portfolio.

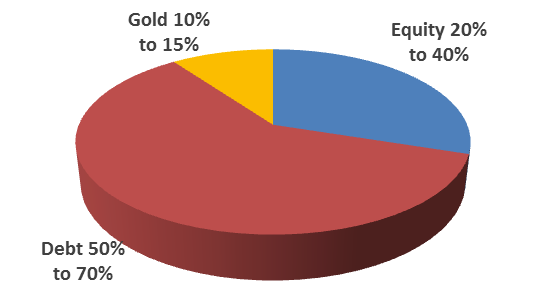

Portfolio Type - Conservative

The chart above is indicative

The chart above is indicative

(Source: PersonalFN Research)

You should limit your exposure to equities to 40% of your portfolio, based on your age and risk appetite. If you are about to retire in the next two years, then your equity exposure should be at the lower end of the mentioned range. Consider investing in a mix of large cap, multi cap, with a minor exposure towards mid cap funds. Since you may have gained some expertise and developed conviction in equity markets, you may hold 5 to 6 good dividend yielding large cap stocks in your portfolio with a long term view.

Your exposure in debt can be in a range of 50% to 70%. While you do not need regular cash flow at this point of time, park your money in long term safe instruments. Bank Fixed Deposits, Corporate Fixed Deposits (highly rated), PPF and Debt Mutual Funds are best suited for you. These can be held with a 3 to 5 years view. On maturity, when you have entered the age of 60 years, these instruments can be gradually rolled out towards instruments generating regular cash inflows.

Hold an exposure to gold in the range of 10% to 15%. This will take some care of your portfolio during economic turbulence and be a store of value.

For Individuals above 60 years having a time horizon of up to 10 Years

If you're above 60 years of age, we assume you may have already retired. You've completed the conservation and protection phase of your life and entered the gifting and distribution phase of your life.

At this stage, you might have limited income or no income to service your retirement and other commitments.

What to do in such a case? Well, you need to dip into your savings and reserves that you have built over the years. But don't forget, that you would need to fund your retirement for at least 10 years or more. So, spend your money wisely.

At this age, you may not afford to take risk; however you also need to generate regular income through your investments. And with inflation eroding the purchasing power of your money, you need to generate a decent real rate of return (also known as inflation-adjusted returns).

So how should you allocate assets in your portfolio?

Portfolio Type - Very Conservative

(PersonalFN Research)

(PersonalFN Research)

Exclude, the house you live in - your primary home - from your investment portfolio. If you own a second house, it can help you generate monthly income when you rent it out. The gold you own can act as a store of value, a saviour in times of economic turmoil. Your allocation to equity in the entire portfolio should be minimal depending on your risk profile. Consider 3 to 4 good large cap, multi-cap and balanced mutual funds with a 5 to 10 year time horizon.

A predominant portion (around 70% to 85% of your portfolio) should be held in fixed income generating instruments.

For Regular Cash inflows, you can consider:

Post Office Monthly Income Scheme (POMIS);

Short Term Debt Mutual Funds;

Annuity from your pension;

Bank Fixed Deposits (for senior citizen);

Senior Citizen Savings Schemes;

Corporate Fixed Deposits (highly rated) etc.

Finally, here are a few...