PersonalFN's

Presents

How To Become

Your Own Financial Planner?

An exclusive Program To Develop The Skills To Manage Your Personal Finance

We believe by signing up for the initiative, you too endeavour to develop the skills needed to understand the nuances of personal finance and be money-wise.

Module III: The Right Approach To Insurance Planning

Welcome to our next session of the module...

Session 7: Should You Club Your Insurance And Investment Needs?

After having determined the amount of life insurance coverage based on the Human Life Value (HLV) - expense method, the next crucial step is to select the appropriate insurance product(s) for insurance planning.

There are a galore of insurance products available in the market today - from term plans to ULIPs to endowment plans, money-back policies and so on. It can be rather perplexing, if the fundamental approach itself is flawed.

So first let's have a look at...

4 Common Mistakes While Buying Insurance

Buying insurance as a tax saving option:

There is no doubt that insurance, amongst financial products, is the most aggressively sold - and more so during the tax planning season. But simply opting for a policy only because it offers a tax deduction u/s. 80C of the Income Tax Act, 1961 is not a prudent approach. Ending up with a bunch of insurance of policies in this endeavour can neither help you address your insurance needs, nor can they effectively address your vital financial goals.

Focus on the premium than on coverage:

While you select insurance policies, you need to ascertain the cost-to-benefit. Going by the premiums alone can be rather a cockeyed approach. Weigh thoughtfully if you are deriving the benefit of an optimal insurance coverage, or you could be seriously underinsured.

-

Non-disclosure of the mandatory information:

If you disclose only partial personal information to an insurer, your family / dependents would be in a hot soup during the claim settlement.

Their financial security, that you envisioned, may be jeopardised.

So be honest and disclose all the material information to the insurer. Ensure that the insurance agent has forwarded all the material information that you shared during all the meetings held to avoid feeling betrayed later.

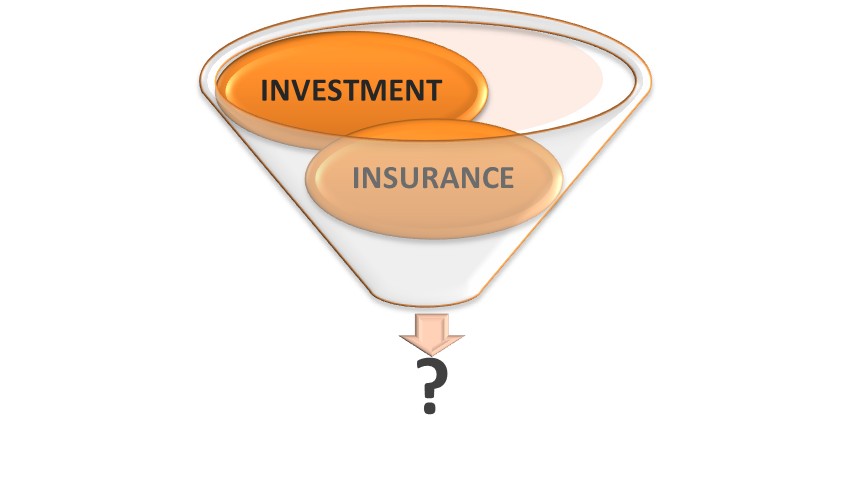

Mixing 'insurance' and 'investment' needs: In an attempt to kill two birds with one stone, many individuals buy insurance-cum-investment products. But in the bargain, you often end up sub-optimally insuring yourself. The sole objective of life insurance, i.e. indemnification of risk to life, is lost - and that should not be compromised.

Here are a few popular insurance-cum-investment products...

The Endowment Plans - This is a traditional plan under which part of the premium paid is utilized towards providing insurance cover, and the rest of the portion is invested (mostly in fixed income instruments). The invested amount provides you a return (usually 5-6%) at the time of maturity. And in case of an untoward event such as death (of the policyholder), the sum assured is paid to your nominated beneficiary. The premiums for these plans are usually high vis-a-vis the returns offered; therefore they falter on the cost-to-benefit basis.

The Money-Back Policy - Here as well, a part of the premium paid is utilized to provide an insurance cover while the remainder is invested. The fundamental difference between an Endowment and a Money-Back policy is that, the insured receives survival benefits at regular intervals in addition to the maturity value. Survival Benefits are generally 20-25% of Sum Assured (SA) which is paid after every 4-5 years. But the returns clocked in such a case are lower vis-a-vis even the endowment plans. The premiums for Money-back policies too are higher. So, they do not derive the needed cost-to-benefit.

Unit Linked Insurance Plans (ULIPs) - This is a market-linked insurance product, so the returns clocked also depend on the options: wealth multiplier (predominantly equity), balanced (mix of equity and debt), and capital protector (predominantly debt), you choose. The returns aren't guaranteed. But unfortunately, ULIPs are often mis-sold. This product makes sense only if you are willing to assume the risk averaged out over a longer investment horizon. But evaluating these from a cost-to-benefit point, is often a challenge given the market-linked nature of the product - where historical returns are no guarantee of future performance. So, you may consider investing in ULIPs to address financial goals, only after having primarily indemnified your risk to life.

So What Should You Opt For?

A Pure Term Insurance Plan by far is the best to indemnify risk to life. It's a pure insurance product which addres ses only insurance needs. It does not commingle insurance and investments. It provides financial security to your family/dependents vide the sum assured on your demise. If you as a policy holder survives the policy term (i.e. the period for which the policy offers you insurance cover), you get nothing - there is no maturity benefit.

While insurance-cum-investment lure you to kill two birds with one stone, it does not counter inflation, owing to not-so-efficient returns compared to other wealth creating investment products and on account of the loads/charges.

Term Plans have the lowest premium structure and come with a policy term of 15, 20, 25, 30 years and so on with an aim to provide longer life coverage. They can be bought either online or offline - each have their own pros and cons.

Term plans are cheap compared to insurance-cum-investment policies and provide a better cost-to-benefit advantage. Therefore stay away from the latter; keep insurance and investment needs separate.

Finally...

Buying insurance should be a conscious and continuous activity. You need to review your insurance requirements periodically paying heed to the present conditions. May be over a period of time, you would need to buy additional insurance cover in the interest of your family's financial wellbeing.

So, seek the help of an insurance advisor, or financial planner, or a financial guardian, who hold high fiduciary standards and who can handhold you.

Here are a few...

Points to Remember

- Deal with insurance needs and investment needs separately.

A pure term insurance policy is a simple and by far the best to indemnify risk to life and provide for your nominee / beneficiaries' financial security after your demise.

Don't buy life insurance policies simply because it's the tax-planning season. That's not a prudent approach.

Undertake a thorough cost-benefit analysis. Don't buy an insurance policy just because the premium is cheap.

If you're buying ULIPs, sensibly assess if it would really address your financial goals efficiently and whether you are adequately insured.

Remember buying insurance should be approached as a conscious and continuous activity. It needs to be reviewed over a period of time.

Thank You For Participating!

Disclaimer: This is for Private Circulation only and is not for sale. The content is only for information purposes and Quantum Information Services Private Limited ( PersonalFN) is not providing any professional/investment advice through it. It does not constitute or is not intended to constitute an offer to buy or sell, or a solicitation to an offer to buy or sell financial products, units or securities. PersonalFN disclaims warranty of any kind, whether express or implied, as to any matter/content contained herein, including without limitation the implied warranties of merchantability and fitness for a particular purpose. PersonalFN and its subsidiaries / affiliates / sponsors / trustee or their officers, employees, personnel, directors will not be responsible for any direct/indirect loss or liability incurred by the user as a consequence of his or any other person on his behalf taking any investment decisions based on the content herein. It should be used at the user's own risk. The user must make his own investment decisions based on his specific investment objective and financial position and using such independent advisors as he believes necessary. PersonalFN does not warrant completeness or accuracy of any information published herein. All intellectual property rights emerging from this transcript content are and shall remain with PersonalFN. This is for your personal use and you shall not resell, copy, or redistribute this transcript, or use it for any commercial purpose. All names and situations depicted in the transcript content are purely fictional and serve the purpose of illustration only. Any resemblance between the illustrations and any persons living or dead is purely coincidental.