PersonalFN's

Presents

How To Become

Your Own Financial Planner?

An exclusive Program To Develop The Skills To Manage Your Personal Finance

We believe by signing up for the initiative, you too endeavour to develop the skills needed to understand the nuances of personal finance and be money-wise.

Module IV: Prudent Ways To Plan Your Investments

In this module, we'll share insights on how you can be smart money managers in the journey of creating wealth and achieving your financial goals.

Session 11: How To Strike The Right Asset Allocation

"Asset allocation is not that different from what mom told us growing up: don't put all your eggs in one basket." - David I. Lampe

Indeed!

But unfortunately, not many individuals recognise this foremost principle; and as a result their investment portfolio often looks cockeyed; incongruent to the financial goals they're planning for.

They often take more risk, or no risk at all - two extremes - leading to an imbalance in the portfolio construction activity.

Asset allocation is a key element in the process of investing and achieving your financial goals.

Now you may ask: Why Asset Allocation? Can't I get straight away to those great investment ideas that can earn big returns for me?

Yes you can; but only if you hold the conviction that those 'investment ideas' will really 'create wealth' for you.

You would agree that many things in life don't move in a linear direction, or how we expect it too. Hence, planning is imperative. You cannot rule out the risks that come with these rewarding ideas, which ultimately have to match your risk profile too

Why Asset Allocation?

Asset allocation means parking a certain percentage of your investible surplus in respective asset classes viz. equity, debt, gold, and real estate

Through asset allocation, you can strike a balance between risk and reward, keeping in mind your risk profile, your financial goals, and your investment time horizon.

So, asset allocation is an investment strategy.

Asset allocation may sound like a complicated concept, but it isn't!

If you recognise the risk traits of each asset class - equity, debt, gold, real estate, etc. you can successfully allocate assets / investible surplus, wisely, or even hold cash for that matter.

As goes the question "How much proportion of my investible surplus should I park in each asset class?" it gets a little tricky. Honestly, it will depend from person to person.

Having said that, here are a few parameters to define the right asset allocation...

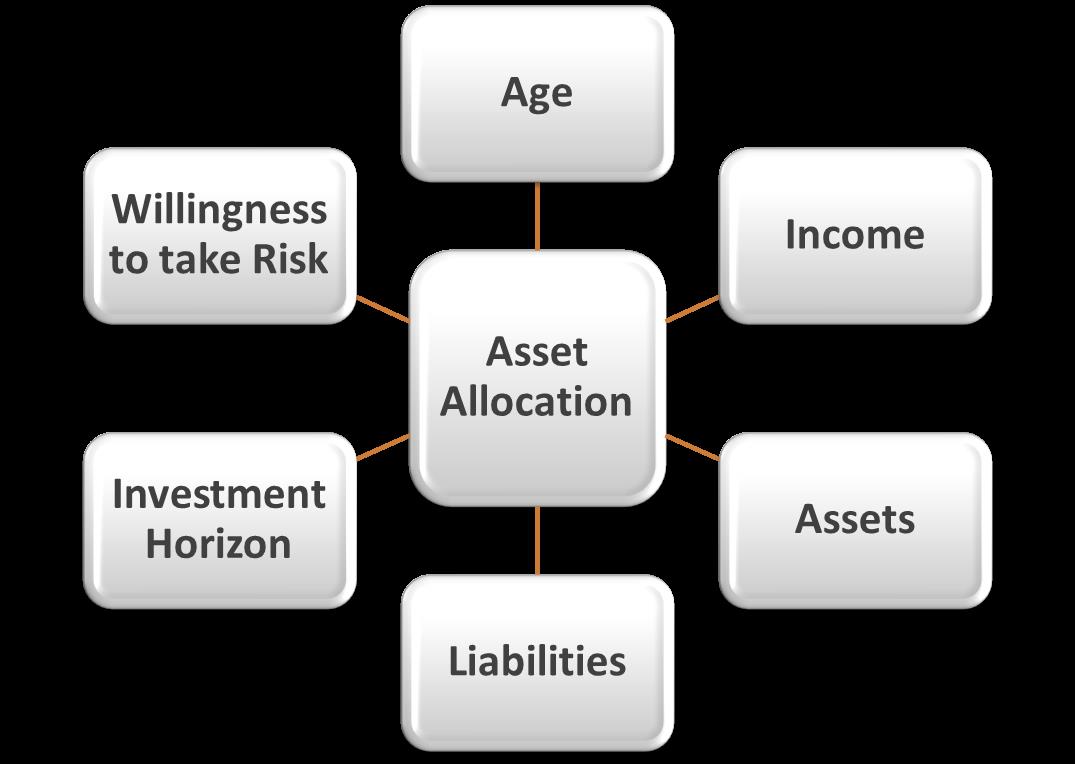

Parameters to Determine Asset Allocation

Age - This is one of the critical factors. When young, the risk-taking ability is high and the earning potential too is more. Besides, the investment horizon usually is longer. So, a greater proportion of the investible surplus can be parked in risk asset such as equity, real estate, and of course, you can buy gold, or hold cash too.

Income - A higher income drives a higher tolerance to risk, which facilitates investing in risky assets such as equities, real estate, gold, and vice versa.

Assets - You should account for your existing asset/s while investing. So consider the existing share of each asset in your investment portfolio, before investing further.

Liabilities - More liabilities to repay, puts a strain on the investible surplus and the level of risk one can take.

Investment Horizon - If the time left before goal befall is longer, it can allow you to take the risk and take exposure to risk asset, and vice versa.

Willingness to take Risk - You got to ascertain if you're willing to take the risk.

But to start off with, you could even...

Go with the thumb rule: which is 100-your age

So as per the above thumb rule, you would be classified as Aggressive, Moderate or a Conservative investor depending how skewed the investible surplus is parked in respective assets.

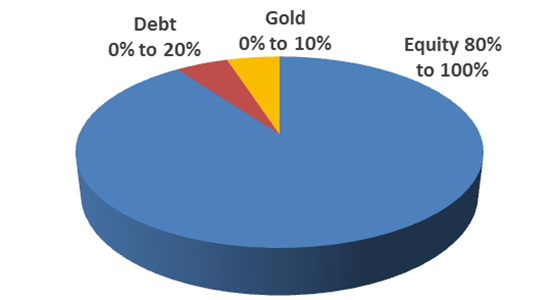

If you are young, your risk appetite will be that of an aggressive investor. So your portfolio would look like:

(For illustration purpose only.)

As an aggressive investor, you'll have more investments towards high risk - high return generating assets like equity vis-a-vis debt and gold.

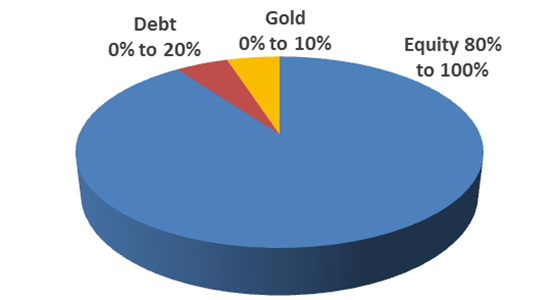

If you are middle aged, you may be a moderate risk taking investor. Thus the asset allocation of your portfolio would look like:

(For illustration purpose only.)

As a moderate risk taking investor, you'll have more balanced portfolio, with your investments well diversified across assets classes. i.e. equity, debt and gold.

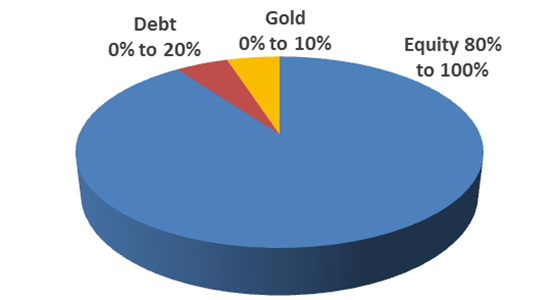

While, if you are senior citizen and have a conservative risk appetite, then your portfolio would look like:

(For illustration purpose only.)

As conservative investor, you'll have more investments towards fixed or regular income generating debt instruments, along with slight diversification towards inflation beating assets like equity and gold.

Avoid including real estate for asset allocation

left Some of you may be wondering, why we didn't talk about Real estate as a part of asset allocation.

The share of real estate in one's portfolio will depend on the investor's individual situation. We believe real estate can be part of one's net worth, but not a part of one's investment portfolio, given their illiquid nature and high transaction cost involved.

Moreover, they cannot be rebalanced with dynamic change in valuation of other asset class.

So avoid including real estate for asset allocation in your investment portfolio.

For those, who approach real estate for investment; can still consider them given its ability to generate rental income and capital appreciation over time.

Here are...

5 benefits of asset allocation

Helps you clock optimal return:

As the investment portfolio is sliced and diced into various asset classes and investment avenues, the returns clocked are potentially optimal; instead of investing in an ad-hoc manner.

- Helps you minimise risk:

It is important to note that all asset classes don't move in the same direction. Some move inverse to each other -- for e.g. equity and gold. Asset allocation facilitates diversification, which is one of the basic tenets of investing, and thus the risk to your investment portfolio is minimised.

Further, as you continue to receive notional returns on your portfolio, it becomes imperative to closely track on the asset allocation to make sure that it doesn't slip from the 'ideal', or what best suits your financial goals. Therefore, while reviewing your portfolio, don't forget to rebalance the investment portfolio as and when the need arises. This will help you minimize risk on your investments and will also infuse more certainty on achieving your financial goals.

- Helps align your investments as per time horizon:

As mentioned before, your time horizon is also a key factor in determining your ideal asset allocation while you endeavour to achieve the financial goals envisioned. Longer the time horizon before your financial goals befalls, the more you can tilt your asset allocation towards risky assets.

Ensures adequate liquidity:

Liquidity is another vital factor while making investment decisions as some investments have a lock-in period, which means these can't be redeemed within that period. For e.g.: If you are investing in a Public Provident Fund (PPF) account or Equity Linked Saving Scheme (ELSS) mutual fund and are in need of money in the next one year, they aren't the right investments for you no matter how good these investments might look. Prudent asset allocation will enable you to have sufficient liquidity to pay for your financial goals as and when required.

Can help in tax planning:

Tax consequences are different for every individual in every scenario. Therefore, always evaluate investments from a tax angle to assess it they're efficient. For e.g.: If you happen to be under the 30% tax bracket and invest all your savings in fixed deposit to keep your investments safe, you are making a big mistake! You're paying a huge amount in taxes that otherwise could have been legitimately saved. So, proper asset allocation will not only help you benefit across asset classes, but also the right investment product that will help you to minimize taxes.

You see, when you diversify across assets wisely, you give yourself a lot of leeway to counter market uncertainties. It acts like a stabilizer when a particular asset class fails to perform.

Till the time an asset class such as equities is progressing well, you'll probably not appreciate the importance of appropriate asset allocation. In fact, you may even feel that asset allocation is a hindrance.

But it is often said that, every adversity leads to diversity, and that holds true even in case of asset allocation to fully appreciate its importance.

Finally, here are a few...

Points to Remember

Asset allocation is an important element in the process of achieving ones financial goals. It's an investment strategy.

Age, income, assets, liabilities, investment horizon, risk profile, are the key parameters to determine asset allocation.

- Go with the thumb rule: 100 - your age, while allocating your investment portfolio across asset classes.

Avoid including real estate for asset allocation in your investment portfolio.

Asset allocation helps strike a balance between risk and reward.

An ideal asset allocation can provide adequate liquidity to your portfolio.

Thoughtful asset allocation acts a stabilizer when a particular asset class fails to perform.

Don't forget to timely rebalance your portfolio so that the asset allocation does not go askew.

Thank You For Participating!

Disclaimer: This is for Private Circulation only and is not for sale. The content is only for information purposes and Quantum Information Services Private Limited ( PersonalFN) is not providing any professional/investment advice through it. It does not constitute or is not intended to constitute an offer to buy or sell, or a solicitation to an offer to buy or sell financial products, units or securities. PersonalFN disclaims warranty of any kind, whether express or implied, as to any matter/content contained herein, including without limitation the implied warranties of merchantability and fitness for a particular purpose. PersonalFN and its subsidiaries / affiliates / sponsors / trustee or their officers, employees, personnel, directors will not be responsible for any direct/indirect loss or liability incurred by the user as a consequence of his or any other person on his behalf taking any investment decisions based on the content herein. It should be used at the user's own risk. The user must make his own investment decisions based on his specific investment objective and financial position and using such independent advisors as he believes necessary. PersonalFN does not warrant completeness or accuracy of any information published herein. All intellectual property rights emerging from this transcript content are and shall remain with PersonalFN. This is for your personal use and you shall not resell, copy, or redistribute this transcript, or use it for any commercial purpose. All names and situations depicted in the transcript content are purely fictional and serve the purpose of illustration only. Any resemblance between the illustrations and any persons living or dead is purely coincidental.