PersonalFN's

Presents

How To Become

Your Own Financial Planner?

An exclusive Program To Develop The Skills To Manage Your Personal Finance

We believe by signing up for the initiative, you too endeavour to develop the skills needed to understand the nuances of personal finance and be money-wise.

Module II: How To Plan Your Key Life Goals

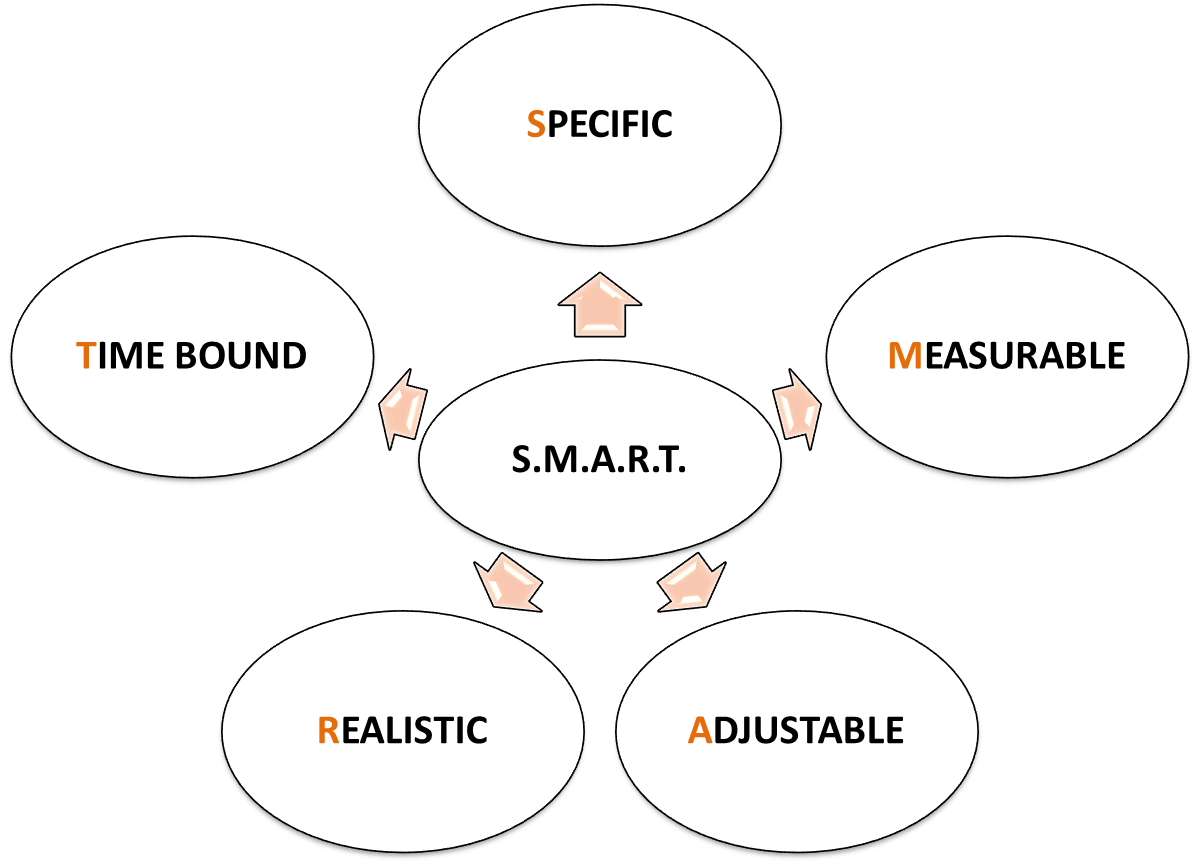

Session 4: 5 Ways To Ensure That Your Financial Goals Are S.M.A.R.T.

We all have financial goals in life - even if we don't really think of them as goals per se.

For example, you might want to buy a new cell phone, or a new car. You might even want to take a family vacation next year, or renovate your home, buy a new house, provide the best education to your children ...all these effectively are financial goals.

Some people prefer to keep it simple, they say: "I want to become rich!" That's itself is a financial goal. If you think about it, being wealthy, or wealthier, enables you to accomplish the materialistic things and safeguard the wellbeing of your family.

But just saying, "I want to become rich!" is not enough; you ought to plan well and ensure that ...

The financial goals you set are S.M.A.R.T.

Well, here's what we mean. Your goals need to be:

Specific

Measurable

Adjustable

Realistic; and

Time bound

Here are...

5 Ways to Ensure That Your Financial Goals Are S.M.A.R.T.

-

Ask yourself is the goal Specific?

'Becoming rich' doesn't turn into being a financial goal; it's a desire, or a wish, unless you're absolute specific. You got to ask yourself several questions...

-Who is the goal for?

-Why do you want to achieve this goal i.e. benefits, reasons, purpose behind the goal

-What do you want to exactly achieve?

-When is the goal expected to be achieved?

-What are the requirements and constraints to your goal?

"I want to become rich" is a vague goal. You need to be specific, quantify the goal.

For example, say I want to build a portfolio worth Rs 2 crore within 15 years, and to make it a reality, have an action plan in place.

Is it Measurable?

When you set a goal, and you start working towards achieving it, it's vital to assess how much you've accomplished. If you set a target and have a time-line, you'll be able to monitor your progress and give yourself a pat on the back at every milestone passed. With every piece of your goal successfully achieved, you'll be spurred on to do even better.

So, suppose you are saving up for a family vacation, and you figured that you need to save Rs 10,000 per month for 12 months to go on that vacation next September; your goal is measurable.

Each month you will be able to see how much you have saved, whether you need to increase your savings, or you can relax a bit and treat yourself for extra savings done ahead of time.

Just remember, the more specific the goal, the easier it is to measure.

Is it Adjustable?

Don't make the mistake of setting financial goals that are too rigid. Because any unforeseen event can throw the goal off course and dampen your motivation to keep going.

You can achieve 100%, or 85% or 50% of your goal. You can achieve them early, or late. So, be a little flexible, but ensure your accounting the changes that take place in your life to achieve the financial goals you've envisioned.

For example, you might have started saving for your retirement, when recession hit and you lost your job. This probably caused you to deplete your contingency reserve and dip into your retirement funds to meet expenses until you get another job. This is obviously not ideal, but worrying about not achieving your retirement goal on time will get you nowhere. When you get another job, make sure you build up your retirement savings again. You may need to adjust your retirement goal corpus or time-line, but that's alright, because your goal should be adjustable.

Ask yourself, is the goal Realistic?

You can't be setting goals that are unrealistic. It would do your health and wealth no good. So, conduct a 'reality check' and then plan accordingly. This will be a fair approach. And by God's grace if your fortunes take a turn for the better, you can always revisit your goals and up the ante.

So, if you say, 'I want to buy an ultra-luxurious sedan next year', when you can afford a decently comfortable hatchback today, that'll be a cockeyed ambition.

Plan for financial goals that your personal finances allow you today. If you set up a financial goal list that is basically a list of all your heart's desires, you might be disappointed if things don't seem achievable. Let your list of financial goals be realistic.

Prioritise, know your capabilities, and stretch yourself a little, but don't overdo in a way that can hurt you in any way. Remember: money is a means to an end, not an end in itself.

-

Is the goal Time-bound?

Setting specific, adjustable, realistic goal is great; but without a timeline, they can never be measured.

Saying "I want to buy a new car" is not time-based, neither specific nor measurable.

But saying "I want to buy a hatchback car worth Rs 6 lakh in the next 18 months" is time based, specific and measurable.

A timeline to a goal helps you figure out how much you need to save each month, invest and how long (if at all you need) to accomplish the set financial goal.

With no time frame, there's no sense of urgency, or yardstick to measure your progress.

The process of setting your goals is an exercise that will give you incredible insight into yourself and the things you value. You'll be able to see your aspirations take shape, become specific intentions that you will be able to take steps towards. Setting S.M.A.R.T goals will help you distinguish real wants and needs from daydreams.

A case in point:

One of our clients, Mr Jason (named changed to protect privacy) was finding it difficult to achieve his goals, despite doing his best to save. So, here's how our Financial Planners helped him...

Incorrect Approach |

Prudent Approach |

I need money to pay my child’s college fees in a year’s time |

I will need Rs 15 lakh for my daughter’s education after 10 years. The saving and investment needed will be Rs 7,000 per month now on. |

I wish to repay the hand loan taken from my friends |

In the next six months, I will return Rs 3,000 to my two friends for lending me their money. |

I will save money |

I will save Rs. 2,000 each month by cutting down on some of my expenses. |

I will purchase a hatchback 2 years hence |

I will save Rs 15,000 per month for the next 2 years for a hatchback worth Rs 5 lakh, and in case of deficit take a car loan. |

(Source: PersonalFN Research)

You see, setting S.M.A.R.T. financial goals serve as maps to achieve them; so make sure you're following a prudent approach.

Finally, here are a few...

Points to Remember

-

Your financial goals are your personal goals with financial cost attached to them. So, identify them S.M.A.R.T.ly

Specify what exactly you want to achieve. Quantifying helps in better goal planning.

Ensure that you're saving enough to meet the financial goals you envisioned. Prudent budgeting can help you go a long way to achieve vital financial goals of life.

Don't set goals that are unrealistic. It can be damaging for your health and wealth. A realistic goal represents an objective toward which you are both willing and able to work. So, ensure that you have the available resources to achieve the goal.

Don't be too rigid; set goals that are adjustable, and be flexible in your approach.

Make sure the goal is Measurable - this can help track the goal well.

Have a timeline in place for each of the goal, clearly knowing when the respective goal will occur.

Don't confuse your financial goals with a wish.

Thank You For Participating!

Disclaimer: This is for Private Circulation only and is not for sale. The content is only for information purposes and Quantum Information Services Private Limited ( PersonalFN) is not providing any professional/investment advice through it. It does not constitute or is not intended to constitute an offer to buy or sell, or a solicitation to an offer to buy or sell financial products, units or securities. PersonalFN disclaims warranty of any kind, whether express or implied, as to any matter/content contained herein, including without limitation the implied warranties of merchantability and fitness for a particular purpose. PersonalFN and its subsidiaries / affiliates / sponsors / trustee or their officers, employees, personnel, directors will not be responsible for any direct/indirect loss or liability incurred by the user as a consequence of his or any other person on his behalf taking any investment decisions based on the content herein. It should be used at the user's own risk. The user must make his own investment decisions based on his specific investment objective and financial position and using such independent advisors as he believes necessary. PersonalFN does not warrant completeness or accuracy of any information published herein. All intellectual property rights emerging from this transcript content are and shall remain with PersonalFN. This is for your personal use and you shall not resell, copy, or redistribute this transcript, or use it for any commercial purpose. All names and situations depicted in the transcript content are purely fictional and serve the purpose of illustration only. Any resemblance between the illustrations and any persons living or dead is purely coincidental.